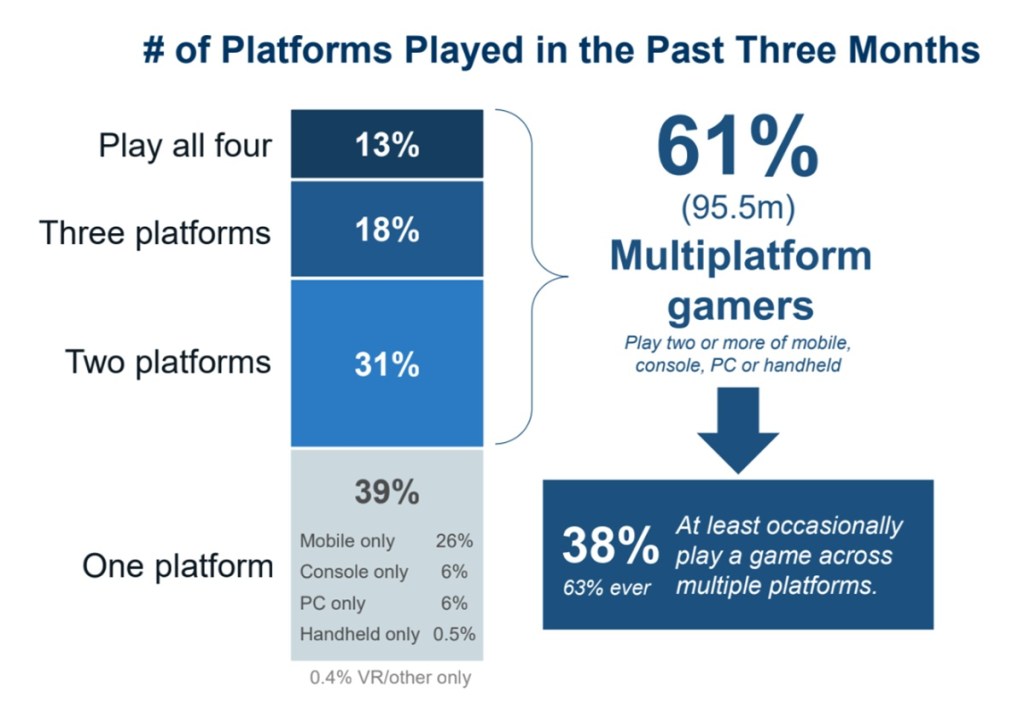

Gaming has become a cross-platform world as a survey by the Consumer Technology Association found that 61% of U.S. gamers play across multiple devices.

The survey has a lot of good data, including how the lifecycle and habits of gamers change over time as they age up and have more competition for their time.

The CTA, which organizes the giant CES tech event in January in Las Vegas, polled 2,703 U.S. adults and teens (with parental permission) to discern consumers’ preferences when it comes to video games. They found that the U.S. gaming market continues to grow, with 65% of Americans ages 13 (182.7 million people) and older having played video games on a device in the past three months.

U.S. consumers prefer video games over most traditional entertainment sources, and rank gaming second only to watching TV and movies at home, according to the U.S. Future of Gaming study.

“This time we decided we’ll take a pause, and we’ll go deeper on the gaming population,” said Steven Hummel, senior manager of market research at CTA, in an exclusive interview with GamesBeat. “We were thinking about how gaming fares with the entertainment value relative to the TV shows and movies, and one of the big takeaways we found was that for gamers video games ranked No. 2 in terms of the relative value of going to the movies or watching a TV show, on average. But for GenZ and Millennials, gaming is No. 1 by a long shot.”

Types of gamers

The CTA said mobile gaming continues to dominate as the most widely played platform, driven by older casual gamers and female players. Nearly half of all gamers (49%, 77.1 million) select mobile as their primary gaming platform.

Eighteen percent (28.6 million) of gamers are younger hardcore gamers who are the most engaged and purchase the most games and content. Hardcore gamers are likely to be young Millennials (29 years old on average) and more male (73%) than total gamers. They are the most active; they play 42 hours per week, spend the most time playing paid games, spend the most money and are the most likely to purchase and enjoy playing new titles. GenZ is now the biggest cohort of gamers, Hummel said.

Virtually all (91%) of hardcore gamers are multiplatform gamers and are most likely to play on console and PC. They are more likely to adopt and play new gaming technologies, such as VR headsets, smart

TV/streaming media player apps or cloud gaming services. About 71% are game subscribers, and 51% are content creators. They enjoy multiplayer gaming, favor first-person shooters (FPS) and open-world action (OWA) games, and play a greater variety of genres overall. And they are the most likely to play for a sense of achievement, social connection and a way to express creativity.

Hummel said the research verified that many players are playing games that are five years old or more.

“It wasn’t really a shocking find, but it was fascinating to know how many gamers, even the most hardcore gamers, are still playing established titles,” Hummel said.

Core gamers, another group that doesn’t buy as many games and is less affluent, are about 46% of all gamers, or 72.1 million. And 36% (55 million) are casual gamers who are older (41 years old) and least engaged.

The CTA looked at when people played the most, and it wasn’t too surprising that it peaked during COVID, Hummel said.

“About 52% of people said that they were gaming the most prior to last year. And among those, we saw this big spike in in 2021 and in 2020 but the big takeaway there was that, like most gamers, regardless of age, they start gaming at a very early age, between the ages of five and seven.”

It peaks at different ages like six through 12, and then during high school and early college. Then it really tapers off.

Games are second only to TV/movies in entertainment value

Video games are second only to watching TV/movies at home when it comes to providing entertainment value, ranking ahead of music, watching movies at a movie theater and print media. Video games rank first among Gen Z and Millennial gamers, while Gen X and Boomer/Mature gamers still favor TV shows or movies at home.

Nearly 40% of a gamer’s leisure time is spent playing video games, and 40% agree that they would rather play video games than watch a movie. Nearly 60% of gamers engage with alternative forms of gaming-related content; watching game videos or live streams, such as on Twitch or YouTube, is most common.

Gaming is already a very social experience, as over two-thirds (68%) of gamers typically play video games with others. Specifically, 60% play games online with others and 39% play in the same room with others, whether online or offline. Notably, playing games with others is driven by younger and more Hardcore gamers, while 81% of Boomer/Mature gamers typically prefer playing by themselves.

Most gamers expect that video games will continue to become even more social (75%) and that they will see more live service games (77%) in the next five years.

Two-thirds agree that video games can introduce them to new friends, primarily driven by younger hardcore gamers. In-game chat support is important, with most gamers preferring an in-game channel of communication versus other third-party options.

Purchase intent

The study found hardware is top of mind for gamers, as nearly two-thirds (64%) plan to purchase a new gaming device in the next year.

More gaming products are being sold as three-in-five gamers (62%) intend to make a gaming peripheral technology purchase within the next year to enhance their experience.

Gaming headsets with a microphone are one of the most widely owned gaming peripherals and one of the top planned purchases to enhance the gaming experience and make it easier to communicate with others while playing.

“The gaming industry’s growth is impossible to ignore, reflecting a cultural and economic shift toward interactive and immersive entertainment,” Hummel said. “Gaming unites diverse audiences and shapes how we experience technology. Whether it’s mobile games driving accessibility or hardcore gamers pushing the envelope in innovation, the opportunities for developers and hardware makers to grow their customer base are vast.”

About 23% of gamers said they wanted better gaming hardware. That’s good, considering Nintendo is planning to come out with the Switch 2 next year — the Japanese company’s first new hybrid console since 2017. In the next 12 months, 26% of gamers say they plan to buy a game console, Hummel said. About 20% of gamers said they own handheld consoles, but it’s not yet a dominant primary device. Virtual reality is being held back by the cost of the devices being too expense, Hummel said.

Tariff uncertainty

But there are clouds on the horizon. With U.S. president-elect Donald Trump saying he will impose tariffs on China on the day he takes office in January, the game industry could get hit by the fallout, said Hummel, in an interview with GamesBeat.

A recent CTA study on the impact of tariffs, including 60% tariffs on imports from China and 10% to 20% on imports from other countries, as proposed by Trump, found video game console prices could rise by 40% ($246). CTA’s gaming study found gamers are generally satisfied with their gaming platforms, but price remains a sticking point. And 41% of gamers who don’t play on consoles say it’s too expensive.

Aging gamers

Most gamers (57%) enter the market between ages five and 12, while gaming activity peaks in high school (ages 15 to 17) and significantly declines after college (age 22-plus) when work and other life obligations take hold. About 63% say they don’t play as much when older due to time availability.

Regardless of age or gender, gamers primarily play video games to relax and unwind; however, older gamers (ages 60-plus) are much more likely to play to improve themselves and keep their minds sharp via word, puzzle and other brain stimulation games. As gamers age, they become more casual and turn to mobile devices for gaming.

Gamers are generally satisfied with their current gaming platforms, but price, controller ergonomics, customer support and backward compatibility present the greatest opportunities to improve platform satisfaction. Gamers most frequently cited better gaming hardware (23%) and games/content (19%) when they were asked about how to improve gaming in the next five years.

A digital generation, subscriptions, free-to-play and gaming IP

Most gamers (69%) prefer playing digital downloads over physical discs, particularly PC and mobile gamers, and they expect to buy nearly twice as many digital games versus physical games over the next year.

Forty percent of gamers currently use or have a membership to a paid game subscription service, and among them, 49% purchased one in the past six months. Game subscriptions are positioned for growth, as 29% of gamers are interested in paying for a subscription within the next year, primarily driven by younger Gen Z and Millennial gamers.

Many gamers (68%), particularly those who are older (ages 60-plus) and more casual, prefer playing F2P versus paid titles as well as older games that have been out a few years versus newly released titles.

Despite being watched most frequently by Gen Z and Millennial gamers, TV shows and movies based on gaming IPs still have a positive impact among all gamers — 44% would be “extremely” or “very” interested in playing a video game based on their favorite shows/movies.

Among the priorities for gamers: they care about accessibility and inclusivity. A little more than half say that they see themselves represented in video games. And accessibility features in games (like graphics for color blind people) are quite popular.

Gaming is going to feature prominently at CES 2025, which gets started in the first week of January in Las Vegas. The show will showcase the latest technologies, content and innovations shaping the industry. Attendees can explore a dedicated gaming area featuring global leaders in gaming hardware, software and content creation. Notably, Nvidia CEO Jensen Huang will deliver a keynote speech at Mandalay Bay on Monday, January 6, at 6:30 p.m.

Other major names exhibiting gaming technology at this year’s show include AMD, Hisense, HP, Intel, LG, MSI, TCL and more.

Source link