Welcome back to our series on how to leverage credit card multipliers to maximize your earning potential. In Part 1, we focused on cards issued by American Express.

American Express is a great bank to accumulate points with because of its vast array of transfer partners available through American Express Membership Rewards. It also has co-branded cards with Air Canada, making it easy to accumulate Aeroplan points, a major player in our Canadian landscape.

Unfortunately, not all retailers accept Amex, given that it tends to levy higher merchant processing fees. Undoubtedly there’ll be times you’ll have to pull out a Mastercard or Visa, so in Part 2 of this series, we’ll now look at category earning multipliers on cards issued by other banks.

For simplicity’s sake, we’ll only focus on Canadian cards that earn airline points currencies or their equivalent, as opposed to cash back cards or other fixed-value points currencies.

Canadian Banks with Airline Partners

American Express has the most flexibility when it comes to transfer partners, with a total of six airline partners and two hotel partners. However, there are still some good Visa and Mastercard options.

In Canada, RBC, CIBC, TD, Brim Financial, and Neo Financial all have credit cards with which you can earn airline points.

RBC

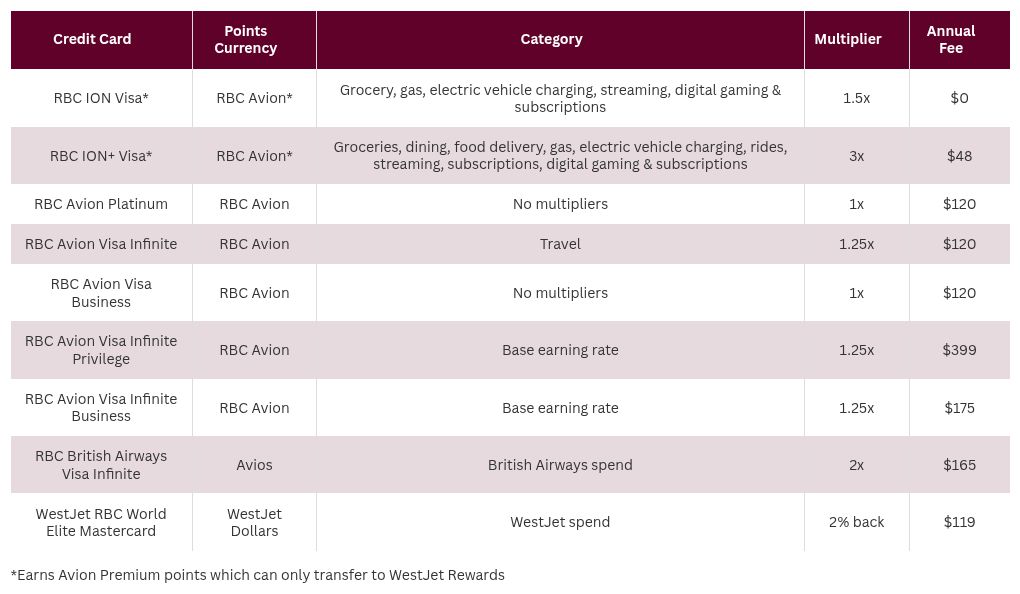

RBC offers a couple of credit cards that can earn airline currencies directly:

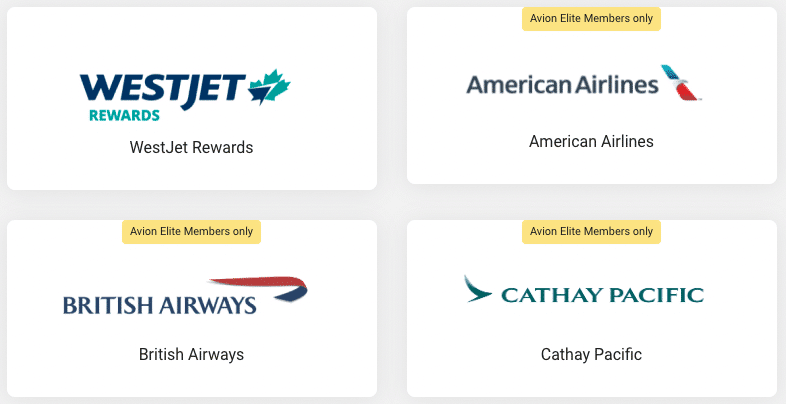

RBC also has its own line of Avion credit cards that earn RBC Avion points. There are two tier of Avion points: Avion Premium points and Avion Elite points.

The ION family of cards earns Avion Premium points which are more restrictive and can only be transferred directly to WestJet Rewards. All other Avion-branded cards earn Avion Elite points, which can be transferred to four airline partners.

The transfer ratios from RBC Avion to the airline currencies are as follows:

Keeping these partners and ratios in mind, let’s look at what the credit card multipliers are, if any:

The ION family of cards takes the prize for best earn rates, but for better flexibility in reward redemption, you’ll want a card that earns Avion Elite points like the RBC Avion Visa Infinite card.

For a higher base earning rate of 1.25 points per dollar spent, grab a premium card, but be sure you can justify the higher annual fee (perhaps by redeeming for business class flights at 2 cents per point).

TD and CIBC

I’ve grouped TD and CIBC together because they both only have one airline program partner, Aeroplan, although keep in mind that any Aeroplan points earned can be redeemed on any one of Aeroplan’s many airline partners.

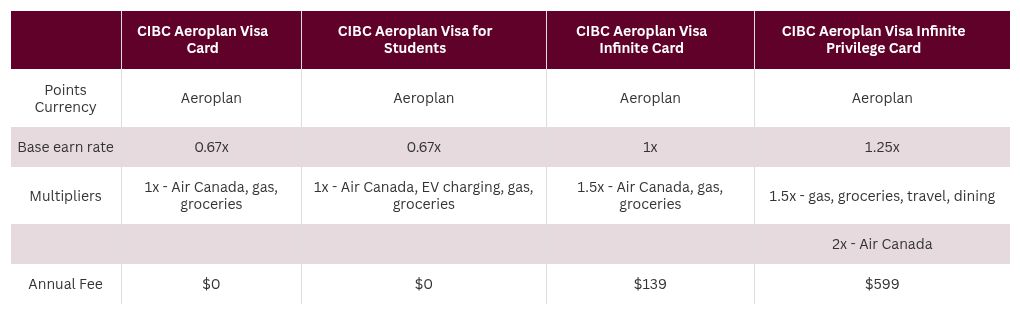

Both banks offer several different tiered Visa cards that will earn Aeroplan points directly:

Now let’s take a look at how their earning rates compare:

Note that for the TD cards with a Starbucks multiplier, you must link your TD credit card to your Starbucks account to earn the multiplier.

The earn rates between different tiers of TD and CIBC cards are rather similar, so when deciding between a TD or CIBC card, it may come down to other factors such as welcome bonuses and other credit card benefits.

If you’re looking for a no-fee entry-level keeper card, then the CIBC Aeroplan Visa Card is a good option compared to the TD Aeroplan Visa Platinum Card, which charges an $89 annual fee.

Keep in mind that TD and CIBC often offer a first year free benefit on their Visa Infinite cards, so with the higher earn rate, you may be better off choosing one of these cards for at least the first year.

Brim Financial

In 2022, Brim Financial launched Canada’s first and only Air France-KLM Flying Blue co-branded credit card, the Air France-KLM World Elite Mastercard.

The card has the following earn rates:

- 1 Flying Blue mile per dollar base earn rate

- 2 Flying Blue miles per dollar spent on restaurants and bars

When you compare earning methods for Flying Blue miles, the Air France-KLM World Elite Mastercard can come out ahead of transferring from American Express. While Amex allows you to convert Membership Rewards points to Flying Blue miles at a 1:0.7 ratio, the direct earning from the Air France-KLM card can prove more advantageous even with its modest earning rates. The annual fee of $132 is also on par with other mid-tier cards.

Periodically, Brim offers boosted earn rates when shopping with select partner merchants.

Neo Financial

After RBC discontinued its Cathay Pacific Visa Platinum card and the HSBC World Elite Mastercard was phased out following RBC’s acquisition of HSBC in 2023, Neo Financial stepped in to fill the gap. Though not widely known among Canadians, Neo Financial now offers Canada’s sole Asia Miles co-branded credit card, the Cathay World Elite® Mastercard.

The card takes a straightforward approach to rewards; instead of offering various category multipliers, it differentiates between purchases made in Canadian dollars and those made in foreign currencies, encouraging its use when abroad.

The card has the following earn rates:

- 1 Asia Mile per dollar spent on purchases made in Canadian dollars

- 2 Asia Miles per dollar spent on purchases made in foreign currencies

- 2 Asia Miles per dollar spent on Cathay Pacific flights

Though the earn rate is pretty standard for purchases made in Canadian dollars, the increased earn rate on purchases made abroad helps offset the foreign transaction fee. You’ll also have to factor in the $180 annual fee which is on the higher end.

Like Brim, Neo also offers elevated earning rates with its retail partners.

Which Non-Amex Credit Card Should You Use?

To determine which card will best maximize your earn, you’ll have to do a personal analysis to see what your spending and travel patterns are.

Your spending patterns will determine which multipliers pertain the most to you. Your travel patterns will determine which airline program you’ll want to invest in, how many points you may need, and whether you can justify the higher annual fee of a card in exchange for the other benefits that may come with it.

If collecting Aeroplan points is your goal, the only non-Amex options are a TD or CIBC Aeroplan Visa card. Which tier of card you choose will depend on what you spend the most on, whether your spend can justify the annual fee, and the welcome bonus at the time.

If you can justify the annual fee of an Infinite Privilege card, you’ll maximize your earn with 1.25x as a base earning rate and 1.5x on most major categories of spending.

If you’re planning to fly on an airline that’s part of the Oneworld alliance, then consider your spending patterns.

For regular spending, it’s a close race between the RBC® Avion Visa Infinite Privilege card or RBC Avion Visa Business card, which earn 1.25 Avios or Asia Miles per dollar spent. The Cathay World Elite® Mastercard is another solid contender, since it earns a minimum of 1 Asia Mile per dollar spent, and is one of the few cards that offer a multiplier on spend in foreign currencies.

If you find value in the American Airlines AAdvantage program (ie. booking Qatar Airways’ Qsuites with the lowest taxes and fees), then RBC Avion-earning cards would be the preferred choice.

For families who travel to Europe regularly, then Air France-KLM Flying Blue’s 25% off discount on award tickets for children will likely appeal to you, and you may find better value using the Air France-KLM World Elite Mastercard for your every day spend.

If you’re looking at a higher base earning rate, then you’ll want to look at the Visa Infinite Privilege cards, which all earn 1.25 points per dollar spent as a base earning rate, and 1.5 points per dollar spent on dining.

The higher earning rates alone, however, may not justify the high annual fee of $599, unless you can take advantage of the other benefits that come with the card.

If you’re a Starbucks fan, then you’ll probably want to look into a TD card rather than CIBC, as they offer a 50% bonus if you link any TD Aeroplan card to your Starbucks account.

And finally, holding both a Visa and a Mastercard in your wallet is also a good strategy as not all merchants will accept both.

Conclusion

Unfortunately, there are still many merchants that don’t take American Express, but that doesn’t mean you have to stop earning airline points.

RBC, TD, CIBC, Brim Financial, and Neo Financial are all banks that offer Mastercards and Visas that can, in some cases, offer better earning rates on airline currencies than American Express.

Take some time to analyze your own spend and travel patterns and see which card or cards will help you achieve your travel goals sooner.